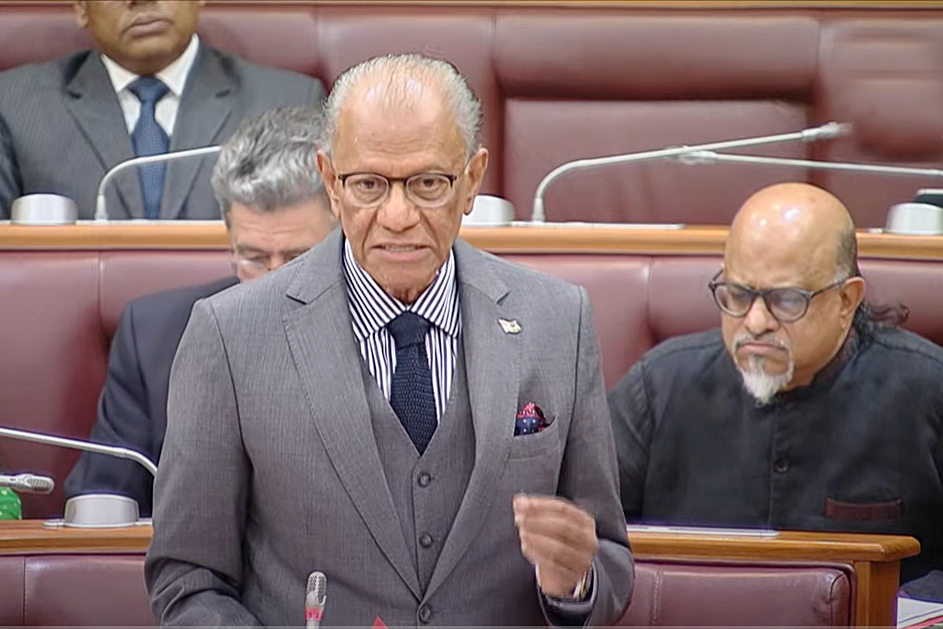

GIS – 15 July 2025: In reply to a Private Notice Question from the Leader of the Opposition, today, in the National Assembly, as regards the value of the Mauritian rupee on the foreign exchange market and its impact on the Mauritian inflation rate, the Prime Minister, Dr Navinchandra Ramgoolam, outlined a series of decisive measures taken by the Government and the Bank of Mauritius to stabilise the Mauritian rupee and curb inflation.

They include:

- Foreign Exchange Market Reforms: In December 2024, the central bank instructed all FX transactions, including swaps and derivatives, to be conducted only through licensed institutions. It also tightened due diligence on intercompany FX dealings to prevent distortions from a parallel market.

- Key Rate Adjustment: In February 2025, the Bank of Mauritius raised the Key Repo Rate from 4.0% to 4.5%.

- Fair Pricing of Forward Transactions: The Bank of Mauritius issued guidance to banks to ensure FX forward pricing aligned with market fundamentals.

- Regulatory Alignment: Discrepancies between the Financial Services Commission and the Bank of Mauritius in FX oversight were resolved, especially concerning Treasury Management Companies.

- Stakeholder Engagement: Regular monthly meetings with banking treasurers have been instituted to maintain a collaborative approach to market stability.

Dr Ramgoolam recalled that, as a result of these interventions, the rupee has stabilised on a trade-weighted basis adding that it appreciated by 4.8% against the US dollar, although it depreciated slightly against the euro and pound sterling.

To cushion the public from price hikes, especially on essential goods, the Prime Minister also listed out key anti-inflationary measures.

They comprise:

- A Rs 5 per litre reduction in fuel prices in December 2024.

- Targeted price controls and markup limits of 25–30% in Mauritius and 5–8% in Rodrigues.

- Removal of VAT on basic goods including frozen and canned vegetables, infant nutrition, and baby food, effectively reducing retail prices by 15%.

- Tighter enforcement by the Ministry of Commerce.

- Establishment of a Rs 10 billion Price Stabilisation Fund, with an initial Rs 2 billion contribution, to support further consumer protection efforts.

The Prime Minister concluded by reaffirming Government’s commitment to a new economic model based on investment, innovation, exports, and local production. “We are changing the economic paradigm from one that relied excessively on consumption, imports and money illusion to one anchored on investment, exports of goods and services, innovation and technology. We also need to produce more locally and lower the import bill. We also need to produce more domestic clean energy, and lower the trade deficit. In addition, we will have to lower the fiscal deficit and borrowing requirements and the debt to GDP,” he stated.

Government Information Service, Prime Minister’s Office, Level 6, New Government Centre, Port Louis, Mauritius. Email: gis@govmu.org Website: https://gis.govmu.org Mobile App: Search Gov